Turkey has one of the fastest growing economies in the world.

As the recent statistics for the 1st quarter of 2011 indicate, the

economy has a leading annual growth rate of 11.6 %. The national energy demand

correlates well to this figure. As Turkey is mostly reliant on imported energy

(Figure 1), increasing energy demand worsens current account deficit which

subsequently dampens the success in economic growth. As the energy demand

increases, energy supply does not seem sustainable in terms of both supply

security and the financial profile. Therefore, the country’s energy policy is

focusing on diversifying the sources by developing nuclear power projects and

utilizing domestic fossil and renewable energy sources to a great extent as

well as increasing energy efficiency.

Figure 1: Turkey’s final energy consumption and import dependency

The High Planning Council’s 2009 dated “Electricity Market

and Security of Supply Strategy Paper” stresses the importance of renewable

energy in electricity generation and forecasting to produce 30 % of the

electricity from renewables in 2023. The share of renewables in 2010 was 26.3 %

in electricity generation. So, the target seems conservative at first glance

but the incremental ratio corresponds to a large capacity increase as the

installed capacity is expected to increase from 45 GW to 100 GW between 2009

and 2023.

In order to reach the renewable electricity generation goals,

renewable energy is strongly supported by the mechanisms summarized in Table 1.

Incentive Type

|

Scope

|

Licensing fee

|

Only 1% of the regular licensing fee is paid.

Exemption from the annual license fee for first eight years.

|

Connection to the grid

|

Priority by TSO and

Discos

% 85 reduction in system usage fees for 5 years

(all plants to be commissioned prior to 31/12/2015

– extension possible)

|

Exemption

from licensing and

company establishment obligations

|

For generators with a max

capacity of 500 kW.

|

Purchase

obligation

|

All of the suppliers have to procure renewable power in proportion with their

share in total supply

|

Feed-in tariff

|

For 10 years (all plants to be commissioned prior

to 31/12/2015 – extension possible).

Additional incentives for domestic manufacturing.

|

Fees on land

use

|

If the property in use is in possession of the Treasury,

for first 10 years of operation,

85% deduction

is applied to fees related to rent, right of access,

and usage permission.

85% deduction is applied to fees related to transportation and

transmission infrastructure investments.

Exemption

from the special fees like contribution to the

development

of the woodland villages.

Free

usage of state-owned estates located within the

reservoir

of HPPs holding a RES certificate.

|

Table 1: Renewable incentive mechanism

At the end of 2010, the feed-in tariff (originally 5 – 5.5

Euro cent/kWh) mechanism was changed by law no: 6094 in order to incentivize

renewables further. New feed-in-tariffs (Table 2) are in USD cent/kWh. Schedule

I is applicable to all plants whereas schedule II is applicable to plants

having domestically manufactured equipments (prices can be applied partially).

In this regard, Turkey is aiming not only utilizing its renewable energy

sources but also developing domestic manufacturing skills. This policy will

also help in reducing the sector’s foreign debt resulting from plant equipment

imports.

Price (US Dollar

cent/kWh)

|

|||

Plant Type

|

Schedule I

(10 years)

|

Schedule II

(5 years)

|

Total

|

Hydro

|

7.3

|

2.3

|

9.6

|

Wind

|

7.3

|

3.7

|

11

|

Geothermal

|

10.5

|

-

|

10.5

|

Biomass(including landfill gas)

|

13.3

|

-

|

13.3

|

Solar

|

13.3

|

6.7

|

20

|

Table 2: Feed-in-tariffs

Before law no: 6094, the feed-in-tariff (FIT) mechanism was based

on the Renewable Energy Law (no: 5346) enacted in 2005 and quite simple

respectively. A producer could sell the generated electricity to a distribution

company (disco) at average wholesale electricity price for the previous

year determined by EMRA (applicable price was bounded by 5 and 5.5 Euro cent/kWh limits)

and the corresponding cost would be reflected in the revenue requirement of

that disco. In other words, FIT costs would be paid by the consumers who are

buying electricity from a disco having renewable energy contracts. Thus, FIT support for renewable energy was expected

to be provided only by these consumers. Alternatively, the producers had the

opportunity to sell the electricity in the pool at the market price calculated

on an hourly basis via marginal pricing. Interestingly, none of the producers

have benefited from the FIT’s in that mechanism because market prices were more

attractive than FIT in the average.

It is fair to say that the FIT limit set by the law was not

conducive towards supporting the integration of renewable energy. However,

setting a high FIT could result in a significant burden on retail electricity

price and weaken the process towards a more competitive market as FIT can also be

perceived as a different form of the single buyer model. Instead, the policy

makers preferred to provide a reference price for investors to be considered in

their worst case cash-flow analyses as the electricity market of the country

having a rapidly growing economy was promising. Indeed, this approach became

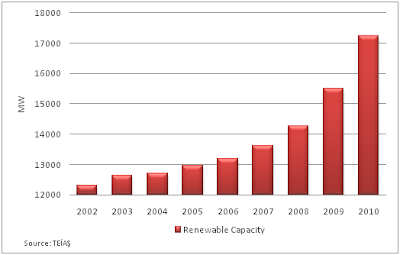

successful and renewable capacity developed significantly (Figure 2). Notice

the rapid increase in additional capacity after 2006 stimulated by enactment of

renewable energy law in 2005 and start of balancing and settlement mechanism in

2006 enabling market players to participate in the market clearing via bids

& offers.

Figure 2: Development of renewable installed capacity

However new law has made dramatic changes in this mechanism.

First of all, the beneficiaries will be a part of the renewable energy supporting

mechanism (RESUM) on an annual basis. Thus, the producers will make their

decisions towards the end of a year in order to participate in RESUM for the

following year and will not be able to leave/enter the mechanism until next

year. The purchase obligation for discos will continue but at the end of the

day FIT costs will be paid by all of the consumers in the country rather than

only the consumers buying electricity from a disco having a renewable portfolio

subject to RESUM.

Thus, every consumer in Turkey will be financing renewables. In

other words, it is mandatory to volunteer in supporting renewables! Details of

the mechanism are as follows:

- Potential beneficiaries are obliged to obtain a RES Certificate from EMRA (license for a renewable energy plant is regarded as a RES certificate) and apply to participate in RESUM for the next calendar year until October 31.

- For exempted generation (power plants with a maximum capacity of 500 kW that are exempted from licensing), distribution companies (in compliance with their purchasing obligation) will also apply to EMRA until October 31.

- EMRA will assess the applications until November 30 and publish eligible ones in its website.

- The mechanism will start in 1st calendar day of the next year and last for the whole year. Thus, beneficiaries will not be able to leave/enter the mechanism until next year.

- For the electricity generated within RESUM, beneficiaries are paid based on the unit prices indicated in Schedule I + applicable portion of Schedule II (Table 2).

- Financial settlements will be done in invoice periods (monthly) via Market Financial Settlement Center (MFSC) that is the market operator. In each period, MFSC will calculate the whole cost of the portfolio in RESUM and reflect this cost to the invoices of load serving suppliers in proportion with their share in total consumption (naturally these suppliers will reflect that cost to the consumers’ invoices). This rate also applies in distributing the revenue (to these suppliers) obtained from the sales of RESUM portfolio in day-ahead and real-time markets at corresponding hourly market prices.

This mechanism has valuable properties as it combines the

renewable supporting mechanism with the liberalized market operations. Thus,

the mechanism will not weaken but rather strengthen the liberalized structure

in parallel with the electricity market strategies. It will also be sustainable

for the government as it does not imply an additional burden on the budget

directly while providing strong incentives for renewables and encouraging

domestic equipment manufacturing. Moreover, the notion to include all of the

consumers in the mechanism looks useful. However, this can also imply a risk

for renewable energy consciousness as the support will be provided via

obligations and probably will not help increase consumer awareness. Nonetheless,

all consumers are going green!

Hiç yorum yok:

Yorum Gönder